The first part of the year started out with a correction amid tariff worries before rising profits, AI enthusiasm, and a resilient economy led the S&P 500 higher. The S&P 500 rose 2.35% in the fourth quarter to finish the year with a 16.39% gain. It was the third consecutive year of double-digit returns. The S&P 500 Index is now up 91.37% from its October 12th, 2022, closing price of 3,577.03 (source: Bloomberg).

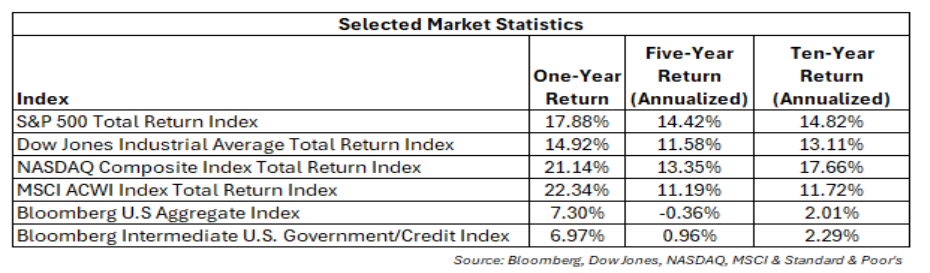

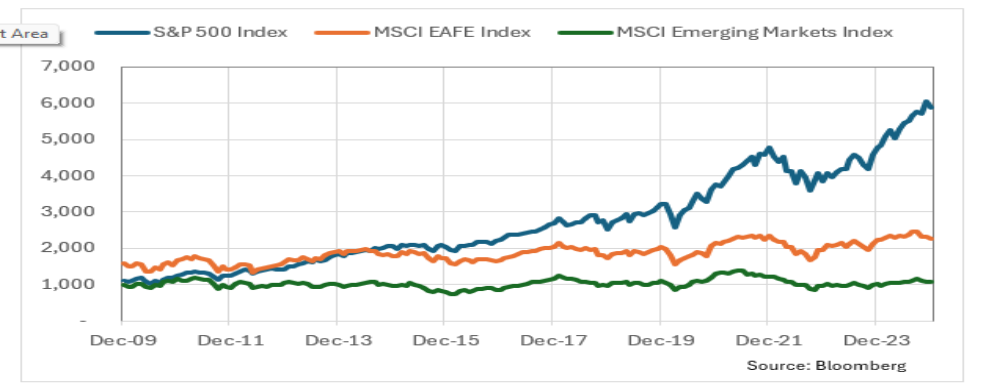

International indices have lagged the S&P 500 for most of the past fifteen years, but that was not the case in 2025. Both developed and emerging markets outperformed American markets in 2025. The MSCI EAFE Index rose 27.89% while the MSCI Emerging Market Index rose 30.58% (source: Bloomberg). International equity outperformance was helped by the weak dollar. The U.S. Dollar Index fell 9.37% in 2025 and ended the year at 98.32, below the ten-year average of 98.51 (source: Bloomberg).

Dollar weakness contributed to the strength in precious metals. Gold rose 13.03% in the quarter and finished the year 64.37% higher (source: Bloomberg). We are not sure if the rally was due to budget deficits, central bank accumulation, geopolitical instability, animal spirits, or all the above. Whatever the reason or reasons, 2025 was a phenomenal year for gold and precious metals.

Fixed income generated solid returns for investors in 2025. Fixed income has been a trouble spot for investors since interest rates dropped due to the GFC. 2025 saw investors in the Bloomberg U.S. Aggregate Index earn 7.30%, while investors in the Bloomberg Intermediate U.S. Government/Credit Index earned 6.97%. Fixed income also provided support to client portfolios in the first part of the year when the new tariff regime led to a correction.

In sum, 2025 was a good year for investors. U.S. large-capitalization stocks did well, international stocks did better, gold outperformed most risk assets, while fixed income provided income and stability in addition to an impressive total return.

Tariffs and Busted Narratives

Tariffs were promoted by President Trump and some of his supporters as a cure for the economy while economists, strategists and CEOs warned of accelerating inflation and a recession. The truth is that neither view was correct (Source: Deng, C. & An-Pham, D. (2025.12.14). WSJ.com). Tariffs did not bring back manufacturing to the United States, nor did they cause an immediate recession and runaway inflation. We believe they caused indecision. Our opinion is that the uneven nature of tariff implementation contributed to soft hiring and capex outside of AI. Continuity is not sure that the current tariff regime will become the status quo. Its popularity is mixed, and it is facing legal challenges at the Supreme Court. Companies are becoming more accustomed to the current tariff regime. We think that the most important takeaway from the tariff experience is that the United States remains a dynamic economy and trying to forecast weakness is extremely difficult.

Equity Leadership Broadens out from U.S. Technology Stocks

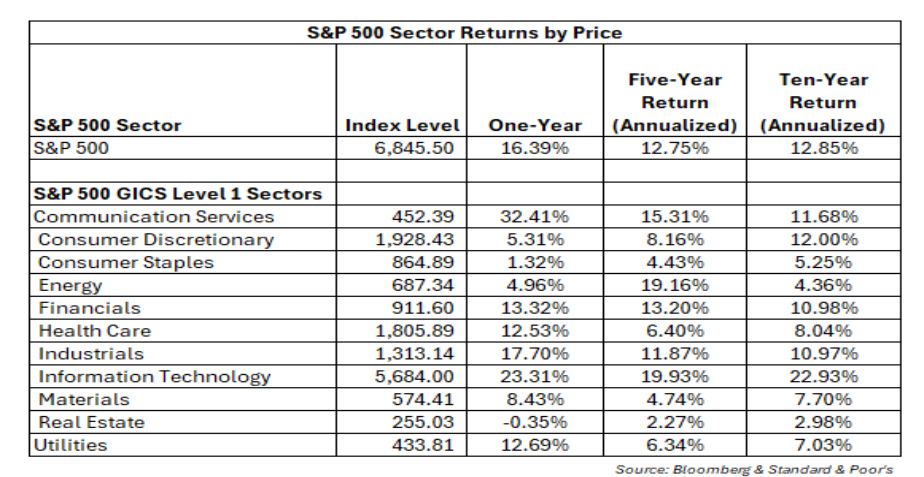

The communication services and information technology sectors were the two best performing S&P 500 sectors in 2025 (source: Bloomberg). However, they were not the only strong performing sectors. The industrial sector outperformed the S&P 500, while financials, utilities and healthcare all appreciated more than twelve percent. Meanwhile, traditionally conservative sectors such as real estate, consumer staples, and energy sectors earned less than the Bloomberg Aggregate Index (source: Bloomberg). We have read reports on why a recession is likely. The market activity tells us a different story.

Many industrial companies stand to benefit from investment in AI infrastructure. Billions upon billions of dollars are being invested in gas turbines, cooling equipment, commodities, etc. to power massive data centers. Increased demand for power from the data centers benefits utilities. In other words, the beneficiaries of AI models are not isolated as opposed to search, social media, or cloud computing where the cash flow accrued primarily to the technology giants.

2025 saw semiconductors vastly outperform software. Large language models require a massive number of semiconductors. Chip companies such as Nvidia and Broadcom along with semiconductor capital equipment stocks massively outperformed software companies.

Continuity expects that 2026 will see a broadening out of the stock market. We do not believe AI is a winner-take-all market. Continuity sees multiple winners emerging in a space that requires massive capital investment. This contrasts with the software and internet businesses which have been cash cows requiring relatively little investment. The prospect of multiple winners and higher capital investments suggests that the margins in AI will not be as great as the margins of internet or software companies where frequently one or two companies dominate.

The S&P 500 massively outperformed the international indices for the fifteen-year period ended December 31, 2024 (see chart). Low valuations, combined with a tech boom where the profits were primarily captured by American businesses saw the S&P 500 dramatically outperform its international counterparts.

We believe the outperformance was largely deserved. The S&P 500 emerged from the GFC with very reasonable valuations. From December 2009 to December 2024, S&P 500 earnings grew at an annualized rate of 10.0% over that fifteen-year period compared to 7.5% and 3.3%, respectively, for the MSCI EAFE Index and the MSCI Emerging Markets Index (see chart). The reasons for this are numerous and includes the dominance of American tech giants.

There are other factors such as fiscal spending and relative interest rates that benefited America but have now turned. The Russian invasion of Ukraine and Chinese threats to Taiwan combined with less American assistance have led to a higher fiscal impulse overseas to finance defense spending. The acceleration in global inflation caused countries around the world to raise interest rates to try and stamp out inflation. European and Japanese financial systems that had struggled under the weight of negative interest rates have benefitted from interest rate normalization.

Additionally, the dollar which had been in an uptrend since bottoming during the depths of the GFC declined 9.37% in 2025 (source: Bloomberg). A depreciating dollar makes foreign securities more valuable in dollar terms. U.S. owners of foreign assets benefited from this in 2025.

The large outperformance of foreign stocks was impressive in 2025. Continuity thinks the relative performance between U.S. and international stocks will be less dramatic moving forward. Nevertheless, international stocks are a useful diversification tool which should produce solid returns over the next few years.

Bond Investors Prosper in 2025

The Bloomberg U.S. Aggregate Index returned 7.30% in 2025, yet that brings the Index’s five-year compounded return to -0.36%. A $10,000 investment in the index on December 31, 2020, is worth $9,819.52 at the end of 2025. The return looks worse after factoring in the loss of purchasing power following the elevated post-COVID inflation.

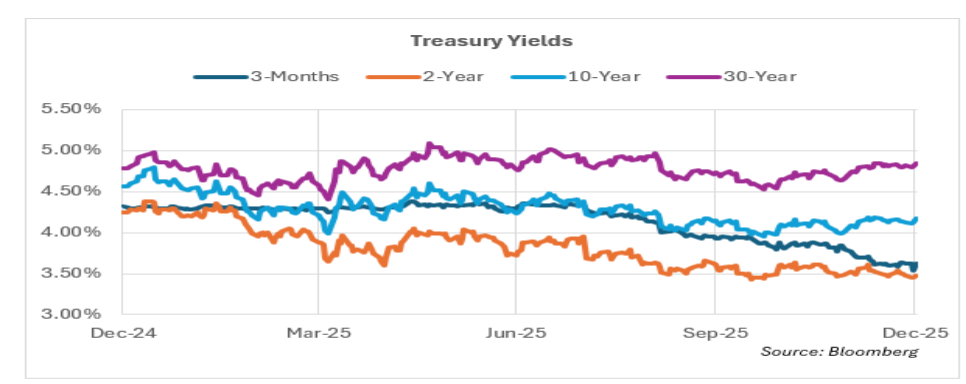

2025 saw most Treasury yields fall, and prices rise except for the 30-Year Treasury Bond which saw its yield rise 0.06% to end the year at 4.84%. The Federal Reserve lowered rates three times in 2025. The 2-Year Treasury often leads the Federal Funds rate, and it did so in 2025. It started the year at 4.24% and finished the year at 3.47%.

Most sub-asset classes such as investment-grade and high-yield corporate bonds outperformed Treasuries in 2025 (source: Bloomberg). Not only that but yields also trended down for most of the year. The biggest temporary drawdown in investment grade bonds, although minimal, occurred when the S&P 500’s April rally began. In 2025, bonds did what investors want them to do. They generated yield while providing diversification against equity portfolios.

Continuity thinks bond investors can expect another good year in 2026, although we doubt the absolute returns will be as good. For one thing, the starting yield is lower than it was at the end of 2024. Secondly, interest rates will have to fall more than they did in 2025 to generate the same total returns as in 2025. If they were to fall across the curve, we think spreads would widen due to economic weakness. Conversely, we would be surprised to see yields rise much from here while employment growth is slow, and inflation data softens. Our takeaway: we think fixed income investors are set up to earn returns more than inflation in 2026 and beyond.

Risk Management, not Risk Aversion in 2026

As we move into 2026, we believe the investment landscape requires disciplined risk management. While 2025 was a phenomenal year for gold and international equities, we expect returns in the coming years to moderate across most asset classes.

Investors will likely face several tests in 2026. Mid-term elections will occur in November while a new Federal Reserve Chair will be nominated in the first half of the year. Markets have a history of testing new Fed chairs. We doubt 2026 will be different.

Corporations continue to deliver strong earnings growth, and analysts predict more of the same. Analysts are currently forecasting 13.64% earnings growth (source: Bloomberg). In our view, it is hard to expect the S&P 500 to fall and stay down for too long under that scenario. However, given that the S&P 500 is trading at a historically high 25.1 times 2025 expected earnings and 22.1 times 2026 estimates, it is unwise to forecast multiple expansion. As such, we would think stocks will generate more muted, but positive returns in 2026.

Fixed income should provide income and diversification in 2026. Continuity sees 2026 as a year to manage risk, not avoid it. The returns should be less than 2025 across most asset classes, but we still think the setup is favorable.

We remain cautiously optimistic. The U.S. economy has proven its dynamism despite the changes and challenges like the new tariff regime. However, it is likely the easy money has been made given current market multiples. Continuity sees 2026 as a year to stay invested while carefully managing risk.