Bonds and International Equities Rise Amidst U.S. Correction

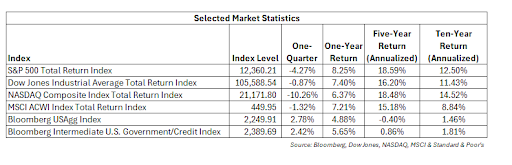

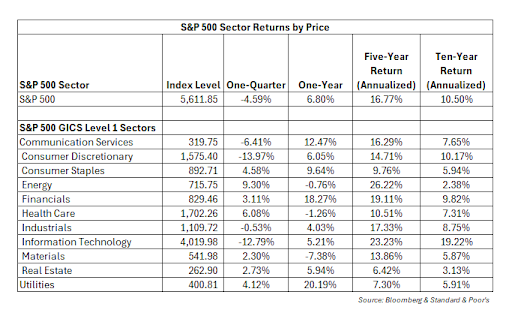

Continuity Wealth Group expected 2025 to be more volatile than 2024, and we have not been disappointed. The S&P 500 dropped 4.59% in the first quarter. It fell 10.13% on a closing basis from peak to trough. The S&P 500 set an all-time closing high on February 19th and then set a 2025 closing low on March 13th.

U.S. large-capitalization stocks, headlined by information technology and internet stocks, had led the market’s rise from its 2022 lows. This changed in 2025. The two worst performing S&P 500 sectors year-to-date are the information technology and consumer discretionary sectors. The information technology sector fell 12.79 % in the first quarter, while the consumer discretionary sector fell 13.97%, weighted down by a 35.83% decline in Tesla.

The S&P 500 information technology sector reached an all-time high on January 6th. It remained close to its all-time high until the announcement of DeepSeek’s artificial intelligence model sent technology stocks, and especially those levered to AI, plummeting. The DeepSeek model was reportedly produced for a fraction of the cost of other AI models. NVIDIA itself fell about seventeen percent on the day (Source: Reinicke, C. (2025,07 27). Bloomberg.com). The S&P 500 information technology sector fell 5.58% on January 27th.

Clients with diversified portfolios know that their accounts have trailed the S&P 500 since the end of the bear market induced by the Global Financial Crisis. International stocks have underperformed the S&P 500, while fixed income has lagged inflation. In the first quarter of 2025, fixed income and international stocks proved their value, while gold continued to shine.

The MSCI EAFE Index return a very healthy 6.15% in the first quarter of 2025, while the MSCI Emerging Markets Index jumped 2.41%. Potential causes of international equity’s outperformance include tariffs, DeepSeek, and slowing U.S. economic data coupled with the expectations of faster European growth due to increased defense spending. Furthermore, U.S. markets had outperformed international equities, so if nothing else, there is room for a mean reversion trade. Whatever the reason, investors who owned international equities did better than those who did not.

Tariff Concerns Lead to a Correction

We thought the likelihood of a correction in 2025 was elevated, but we must admit that the speed of the pullback surprised us a little. Many large companies, including economic bellwether Federal Express, mentioned tariff uncertainty in their outlooks (Source: 2025, 03 20) CNBC).

Continuity thinks that growing global tariffs will detract from economic growth and lead to lower equity returns. This is especially true if retaliatory tariffs are placed on the United States by our trading partners. We think the market is correct to worry about the deleterious effects of tariffs on the U.S. economy. While there are valid arguments that the United States faces unfair impediments in some markets and legitimate concerns that large trade deficits leave us reliant on others, higher tariffs lead us to expect slower economic growth and lower equity market returns.

Whether it was tariffs or something else, the stage was set for a market pullback. Valuations were stretched at the end of 2024 and the market was susceptible to a decline. Corrections can be beneficial when they restore value to a bull market that has gotten ahead of itself.

Economic indicators slowed and several confidence indices declined. The Bureau of Labor Statistics monthly payroll reports indicate that employment continues to expand, but at a much slower pace. The Federal Reserve’s Atlanta Fed GDPNow Forecast stands at -2.80% as of March 31st (Source: Federal Reserve Bank of Atlanta). Recession risks have risen, but one is not inevitable.

Treasury Rates Decline Amidst S&P 500 Selloff

Some commentators were perplexed by what has happened year-to-date. The S&P 500 did extremely well in 2017, the first year of President Trump’s term. The President mentioned equity markets frequently, and it seemed that at times he viewed their performance as a key barometer of his effectiveness as a President. A so called “Trump put” developed in equity markets. This did not happen in the first quarter of 2025. Several analysts have noted that Trump appears to be targeting interest rates instead (Source: Goldfarb, S. (2025, 02 16) WSJ.COM). We agree with this explanation. It is not that President Trump is unconcerned with equity prices. There is a limit to how much pain he can handle. It could have been a coincidence, but his stance on tariffs appeared to soften after the ten percent correction. Nevertheless, President Trump is intent on bringing interest rates down.

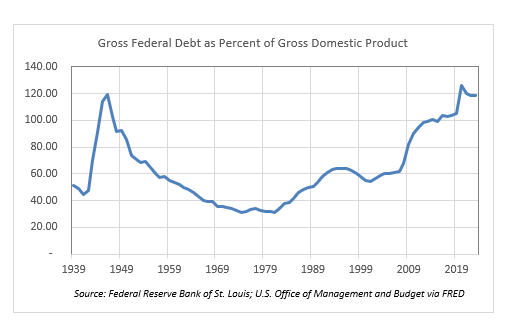

Lower debt costs are beneficial to debtors. The United States has over thirty-six trillion in external debt according to the Department of the Treasury. The difference over time in a one percent drop in interest rates is enormous. A one percent drop in the average borrowing rate for the federal government would save over three hundred billion dollars annually. A drop in interest rates that does not coincide with a recession would be a huge help in reducing the deficit. Debt to GDP is near levels only achieved at the end of World War II and are close to an all-time high.

Additionally, a lower ten-year rate would bring down mortgage rates. New buyers are struggling with affordability, while many buyers with low interest rates do not want to move because they will see their monthly payments rise. Lower short-term rates would also help lower-income consumers who have been pinched by inflation. The size of the fixed income markets dwarfs the size of the equity markets. For now, the President appears to be prioritizing lowering borrowing costs.

This shift contributed to fixed income outperforming equities domestically. The Bloomberg U.S. Aggregate Return Index generated a total return of 2.78% in the first quarter. The Bloomberg High Yield Index also outperformed the S&P 500. It rose a respectable 1.00% in the quarter despite a risk-off move in equity markets. The modest increase in credit spreads was offset by the drop in Treasury yields. Continuity would become more cautious about global equity markets if corporate borrowing costs rose from here. High-yield debt spreads have risen, but not to a level that makes us think that a recession is imminent.

Gold continued to prove its worth in diversified portfolios. The yellow metal rose a remarkable 18.24% in the first quarter of 2025, according to COMEX. Whatever the reason for the increase, gold continued to prove its diversification benefits.

Stay Diversified

Continuity thinks tariffs are likely to increase market volatility and economic uncertainty. The risk of a recession has risen, and we expect one if the tariffs remain in place for an extended period. We would be more optimistic about the S&P 500 than three months ago if not for the increase in tariffs. Some tariffs may be reduced in the future as part of trade negotiations. Unfortunately, that outcome does not seem likely to happen in the immediate future. As such, the April 2nd announcement is likely to extend market volatility and increase downside risk.

Market volatility can help long-term investors, especially those who hold cash. We have targeted a little more cash than normal for clients. The S&P 500 is more reasonable than it was at the end of 2024 if tariffs do not permanently impair corporate profitability. International stocks are probably due to retrace some of the recent rally. We think they can be bought on pullbacks. However, they too will get caught up in the trade war and we expect them to correct along with U.S. stocks.

Continuity does not think fixed-coupon Treasuries are as attractive as they were when the year started, but we think they still offer value and diversification benefits. Recessions normally lead to lower yields and higher prices. However, the increased inflation risk due to tariffs means the reduction in yields could be capped. In a worst-case scenario, tariffs lead to higher inflation, a recession, and higher yields. Nevertheless, Continuity still likes Treasuries maturing in the next seven years. We expect the short to intermediate part of the curve to continue to do well for investors, and we continue to like Treasury Inflation-Protected Securities. The headline risk is unlikely to improve significantly, but we think diversified investors can ride out market volatility.