The S&P 500 closed Monday at 6,033.11, a quick reversal of fortunes after the early-2025 sell-off that saw the index fall close to twenty percent from its closing high on February 19th of 6,144.15. Since bottoming on April 8th at 4,982.77 the S&P 500 has erased nearly all of that decline (Source: Yahoo Finance).

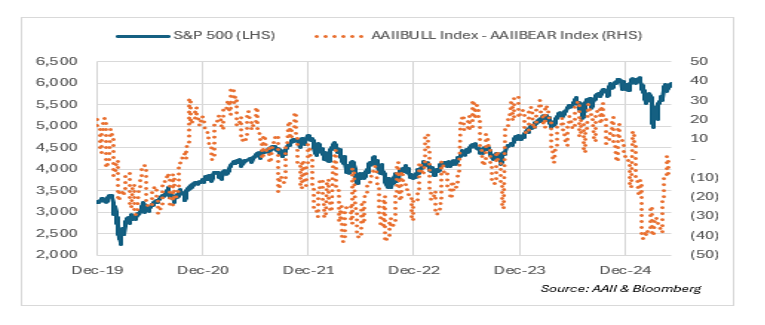

Several factors contributed to the reversal. Firstly, President Trump reduced or delayed some tariffs. Secondly, U.S. economic data remained resilient while investor sentiment and positioning bottomed, laying the foundation for a powerful rally. As you can see on the chart below, the American Association of Individual Investors survey reached levels not seen since 2022, when the Fed was in the middle of what turned out to be a record-setting series of interest rate hikes.

In Continuity’s opinion, though, strong corporate earnings reports were the most important reason for the market’s blistering rally. Investor sentiment is important in the short term, but in the long term, it is fundamentals that drive the equity markets. At least for now, first quarter earnings reports removed investors’ fear of diminished corporate earnings power. S&P sales grew 4.55% while earnings grew 12.73% (Source: Bloomberg).

Importantly, technology and AI-related companies, which had led the market down during the correction, also led the rebound. After declining by 26.31% from its January 6th high, the S&P 500 Tech Sector posted impressive 12.36% sales growth and 19.87% profit growth in the first quarter (Source: Bloomberg). Continuity does not think the quick market and technology stock rebound would have been possible without strong corporate reports.

Solid corporate earnings growth does not mean the economy has avoided a recession and/or that the worst of the tariffs are behind us. Nor does strong earnings growth ensure that stocks will continue to rise in value from here. As long as earnings remain strong, however, it is hard to see the market moving significantly lower and stay there for an extended period.