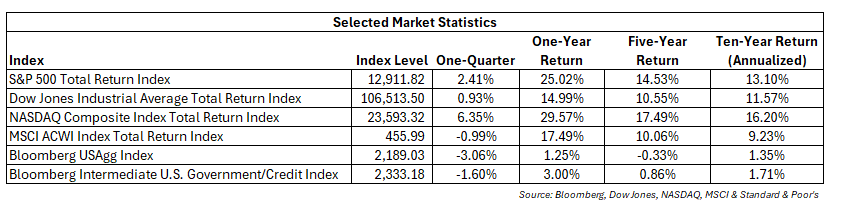

The S&P 500 Index rose more than twenty percent for the second consecutive calendar year following a double-digit decline in 2022. Consecutive years with returns greater than twenty percent occur infrequently in market history. This is only the sixth time it has happened in the history of the S&P 500 according to Bloomberg. The first two occurrences were in 1935-1936 and 1954-1955. The Index dropped 38.59% in 1937 and eked out a modest 2.62% gain in 1956. The only other instances of consecutive 20%+ annual returns occurred in the great bull market of the 1990s. Stocks rose at least twenty percent in 1995, 1996, 1997 and 1998. 1999 saw the S&P 500 rise another 19.53%, before the early 2000s bear market took hold.

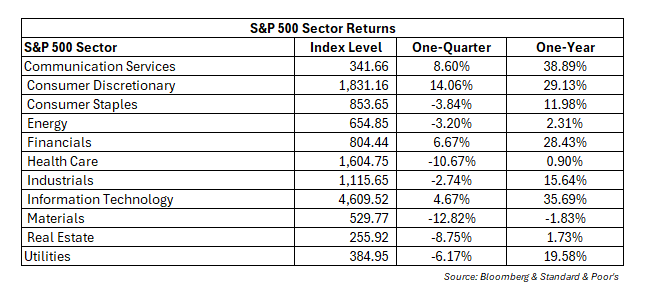

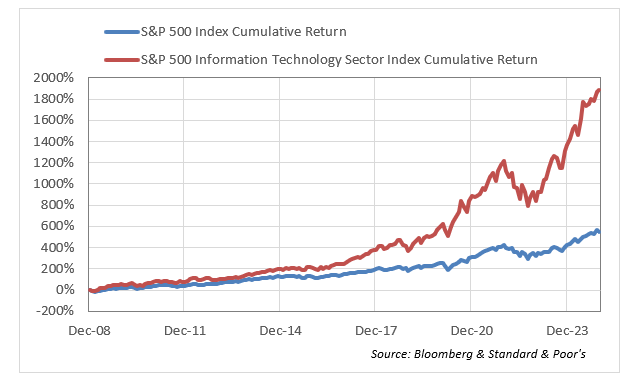

Technology stocks, specifically those levered to artificial intelligence, led the market in 2024. The S&P 500 telecommunication services and information technology sectors returned 38.89% and 35.69%, respectively. Technology stocks outperformed other sectors, continuing a trend that has remained in place for the better part of the past sixteen years (see chart). The NASDAQ and the S&P 500 information technology sector both outperformed the S&P 500 in 2024.

But while tech led the market last year, other sectors also did well. The consumer discretionary and financial services sectors also outperformed the S&P 500 in 2024, returning 29.13% and 28.43% for the year. The strong returns were not uniform throughout sectors. Commodity-based sectors lagged in 2024. The S&P 500 materials sector fell 1.83%, while the health care, real estate and energy sectors generated returns between zero and three percent. We believe the poor performance in oil prices and the energy sector is notable. West Texas Crude Oil barely budged, climbing 0.10% in 2024 (source: NYMEX & Bloomberg), despite geopolitical entanglements in Russia and the Middle East.

Equity returns have been strong since the last secular bear market ended in 2009. The standard equity benchmark, the S&P 500, compounded 13.10% over the last 10 years on a total return basis, which equates to a cumulative return of 242.54%. It has significantly outpaced the standard fixed income benchmark, the Bloomberg USAGG (“the AGG”), which is up 1.35% (the AGG has also lagged inflation over these past 10 years).

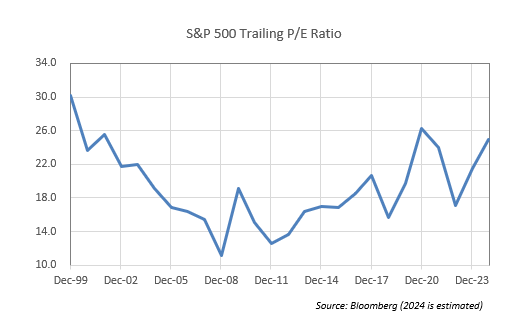

The strong returns in 2024 led to the S&P 500’s price multiple rising from 21.5 at the end of 2023 to an estimated 25.0 at the end of 2024 (see chart). The price-to-earnings multiple concerns us a bit, but we do not think high valuation levels are a reason to make wholesale portfolio changes. Instead, it is a reason to manage risk. Severe bear markets usually occur because of recessions. Continuity Wealth does not believe a recession is imminent. The labor market remains solid while corporate profits are rising. Investments in artificial intelligence and other tech investments should continue to benefit corporate America and stock prices. As such, we think it makes sense to remain invested but acknowledge that multiples are elevated compared to historical norms.

The Intermediate Part of the Curve Looks Attractive to Your Team

Continuity thinks that bond investors can be fairly compensated for risk if they concentrate on the short and intermediate portion of the yield curve. Treasury buyers can earn yields greater than four percent across the curve (source: Bloomberg). The Treasury curve is now positively sloped from one to twenty years. Investors in five-year A-rated corporate bonds can earn approximately 4.87% (source: Bloomberg) without taking much credit risk. Investors willing to take more risk can generate additional yield. This should be enticing for bond investors and offer stability to balanced investors if equity markets turn down.

Consumers Remain Solid in Aggregate

The rise in inflation that started during the COVID-19 lockdowns hit consumers hard, particularly lower-income Americans, and many are still suffering. Personal consumption expenditures account for approximately 68% of GDP according to the Bureau of Economic Analysis. Despite the lingering effects of inflation, it is unlikely that the U.S. economy will enter a recession while employment grows. The Bureau of Labor Statistics reported that the U.S. unemployment rate rose to 4.2% in November, from 3.7% at the end of 2023. While the labor market loosened slightly, it remains historically strong. The rise in the unemployment rate was due to a rise in people entering or reentering the labor market. Total employment is estimated to have increased more than two million in 2024 by the Bureau of Labor Statistics (Source: https://www.bls.gov/regions/mid-atlantic/data/xg-tables/ro3fx9584.htm).

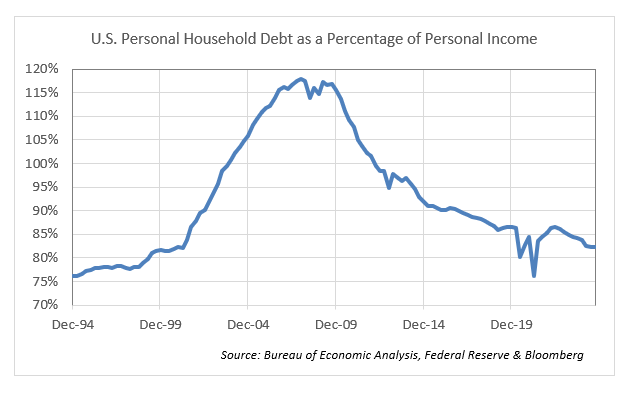

Consumer spending has remained solid, but not all consumers are facing the same circumstances. Mortgage rates have followed interest rates higher. This does not affect people who locked in a fixed-rate mortgage before rates skyrocketed. It does hurt new homebuyers and renters who have seen their shelter costs rise materially. Many of these people are living paycheck to paycheck. Yet American consumers have improved their balance sheets, and their debt levels have fallen as a percentage of income (see chart).

The bottom line is that the lower end consumer is still struggling, while consumers as a whole remain okay.

We See Positive, but More Volatile Returns in 2025

2024 was a great year for equity investors. Moreover, it has been a rewarding sixteen years for equity investors despite several drawdowns. While stock investors have enjoyed an era of extraordinary returns, bond investors have suffered. Over the past 16 years, as stocks returned 13.1% on a compounded basis, investors in traditional bond indices haven’t even kept up with inflation. We think this may change in 2025. Continuity still expects positive returns for the S&P 500, but we think the market is likely to experience a correction over the course of the year. This is not because we think the economy will weaken, but instead because stocks are priced for perfection and even slight adversity is likely to cause a reappraisal of risk. We feel a correction would be a buying opportunity. Continued investment in technology and strong labor markets should support the economy. We think investment-grade bonds should be bought on the short and intermediate end when yields approach or exceed five percent. Summing up, Continuity expects positive returns in 2025, but we believe there will be more volatility than in 2024.