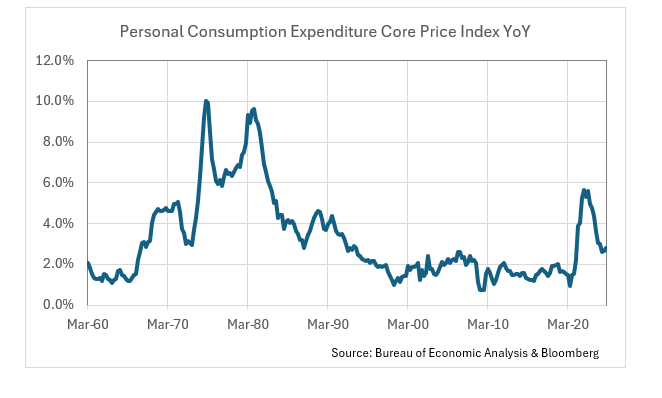

From the end of the 1980s until the beginning of this decade, inflation was relatively contained (see chart). Beginning in 1996, The Bureau of Economic Analysis’ PCE Deflator spent most of the time below two percent. Inflation remained low while interest rates trended lower. However, this changed earlier this decade for a variety of reasons including the supply chain difficulties during COVID, large budget deficits, and monetary easing by central banks.

During the 2000-2002 tech crash/recession and the Global Financial Crisis, long-term Treasury Bonds declined in yield and rose in value, partially offsetting the steep drop in equity values in investors’ portfolios. The reverse occurred in 2022. Broad equity indices declined and any investors hoping for bonds to provide diversification against equities were disappointed. (see table). The Bloomberg Aggregate Index fell 13.0% after losing 1.5% in 2021. This was the first time in the history of the index that bond investors lost money in consecutive years, according to Bloomberg.

Investors that started the year with a “traditional portfolio” consisting of equities and nominal investment grade bonds performed poorly. Portfolios that owned gold and short-term Treasury Inflation-Protected Securities (TIPS) performed better.

The dollar is near the top of a multi-decade trading range (see chart). It is elevated but has moderated recently and its direction is uncertain. All else being equal, a strong dollar dampens inflation as foreign goods and services become cheaper in dollar terms.

Domestically, inflation has fallen from its 2022 highs, but it is still above the Federal Reserve’s two percent target. Continuity Wealth thinks the United States’ budget deficit puts upward pressure on inflation. Moreover, we think there is a high probability of inflation remaining above two percent if the deficit is not reduced. It exceeded two trillion dollars in calendar 2024 according to the U.S. Treasury. Additionally, the threat of tariffs increases economic and market uncertainty while raising the risk of higher prices. The ultimate results and effects on price levels, GDP, and stock prices are unknown and hard to model.

In sum, the world is now characterized by economic and geopolitical uncertainty. Continuity Wealth Group thinks that portfolios need to be structured to reflect these circumstances.

Treasury Bonds spent close to four decades in a secularly declining trend after peaking at close to sixteen percent in 1981 (source: Bloomberg). The Ten-Year Treasury Bottomed at 0.31% on a closing basis on March 9, 2020. It then peaked, at least temporarily, slightly above five percent on October 23, 2023. It has been in a trading range ever since.

Continuity thinks there is a place for short-term TIPS in most client portfolios. They provide current income, even if that income will fluctuate as inflation levels go up and down. TIPS provide diversification against equities and nominal bonds. We also think TIPS provide some protection if interest rates rise due to a pickup in inflation like 2022.

We also think gold is a useful diversifier. Gold does not generate income, but it has served as a store of value for centuries. It is an inflation hedge, especially when citizens lose faith in their own currency. Presently, the supply/demand dynamics favor gold as central banks accumulate the yellow metal (source: Hoppe, J (2025, 09 30) WSJ.COM). We should add that gold has done extremely well recently, and it does give us some concern that it is presently overbought. Nevertheless, we think the drivers of gold performance remain in place, and we would use a pullback to add to client portfolios that do not own gold.

After strong domestic equity returns since the bottom of the global pandemic in March of 2009, Continuity Wealth Group thinks investors would be wise to consider nontraditional asset classes. We do not expect traditional bonds to experience double-digit losses like in 2022, but rising inflation is rarely good for fixed income. We think most investors should consider owning short-term TIPS and/or gold depending on their goals. They are not perfectly correlated with equities or investment grade bonds. Gold and TIPS may not be the best performing asset class in any given year, but they have been more stable in this post-COVID market regime. As always, please contact us if you have any questions.