Another presidential election has come and gone. An election that was close to a coinflip until Tuesday night broke for President-Elect Donald Trump. Additionally, the Republicans regained control of the Senate although the final margin is unknown. As of 4:00 p.m. on Wednesday, November 6th, it is unclear which party will control the House of Representative although it looks like the Republicans will retain control of the House. In other words, it appears that the Republicans achieved a clean sweep. Now that we know the winner of the Presidency and the two branches of government, what if anything should be done in investors’ accounts?

Continuity does not want to be dismissive of the societal implications resulting from which party controls the Presidency and Congress. This has been a divisive election, mirroring other elections in the twenty-first century. The stakes get amplified by social media. In our opinion, the system of checks and balances is strong enough to withstand challenges thrown at it. We are a divided country politically, but that is not a historical aberration. It is a feature of our Republic.

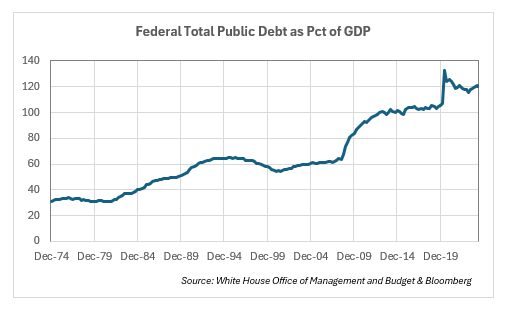

We think that the biggest long-term risk to the leadership of the United States is the budget deficit (see chart). In the runup to the election, neither candidate showed much concern for reining in the deficit based on their budget proposals. A loss of confidence in the United States by investors and the bond market could lead to severe outcomes. Continuity hopes something is done to reduce the magnitude of the deficits. The deficit is problematic, but we do not see any signs that this is an issue for the bond market and investors yet. We fear that it will not be addressed until it becomes a problem.

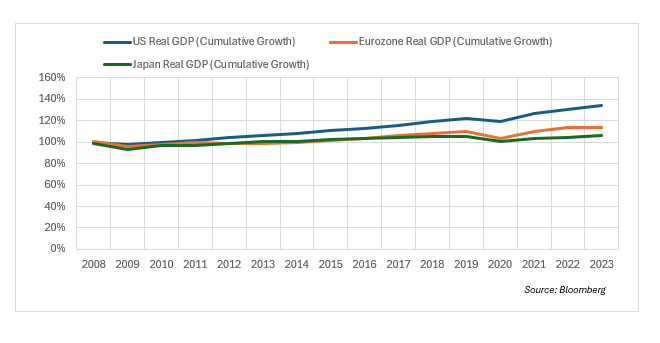

Continuity would like to focus on a characteristic of the United States that we think is important and would have remained intact regardless of the outcome of the 2024 election. The United States has the best and most dynamic global economy in the developed world. Real GDP has consistently outperformed Europe and Japan (see chart). We do not think it is a coincidence that Apple, Nvidia, Google, et al., have been founded and prospered here. China, arguably the United States’ most important economic competitor, suffers from a domestic real estate crisis, unemployment, and terrible demographics. (Source: Feng, R. (2024, 09 30). WSJ.COM)

Continuity believes that Trump’s election will be more important for sectors and industries than it will for broad indices. While the S&P 500 rose 2.53% the day after the election, the performance was not uniform. The financial services sector rose 6.16% and was the best performing sector. Only eight of the eleven GICS sectors increased. The utilities, consumer staples and real estate sectors all declined on Wednesday. Within those eleven sectors there were winners and losers. While the S&P 500 information technology sector rose 2.52%, many solar stocks fell more than ten percent. Enphase Energy, Inc, (ENPH) and First Solar, Inc. (FSLR) fell 16.82% and 10.13%, respectively, according to Bloomberg.

Markets usually hate uncertainty. Now that the Presidential winner is known, Continuity expects positive returns to continue throughout the remainder of the year. We do not think there is a need to make wholesale portfolio changes but plan to incorporate the election results to adjust our portfolios on the margin.

Bibliography

Feng, R. (2024, 09 30). China’s Housing Glut Collides With Its Shrinking Population. Retrieved from WWW. WSJ.COM: https://www.wsj.com/world/china/china-housing-glut-population-economy-09cffa6a