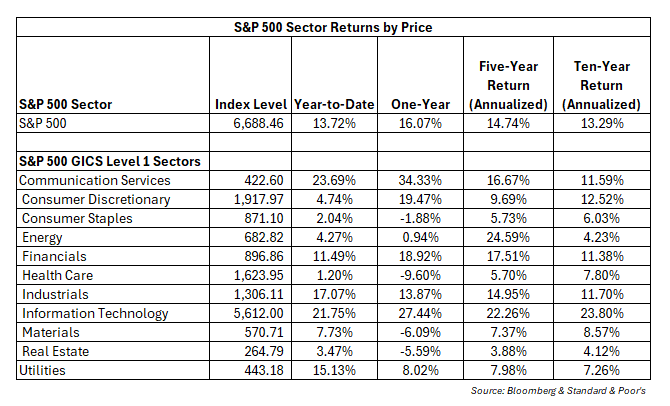

The third quarter saw continued strength across asset classes. Stocks continued their rally, with the S&P 500 gaining 7.79% in the quarter and 13.72% year-to-date (Source: Bloomberg). This momentum was supported by strong earnings and revenue growth, positively skewed economic data, and the Federal Reserve’s decision to lower rates for the first time since December of 2024.

While artificial intelligence stocks led the S&P 500 higher, most stocks did well. Ten of eleven S&P 500 sectors rose during the quarter, with the “defensive” consumer staples sector the only sector to fall.

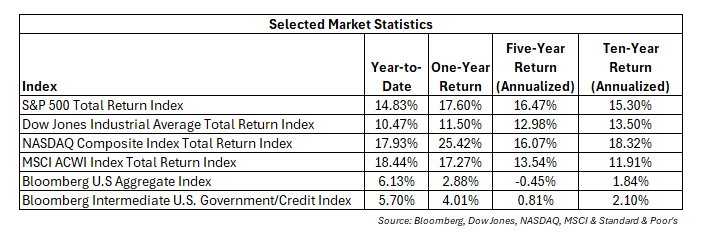

International equities also performed well in the third quarter, especially emerging market stocks. In the first half of the year, international equities were supported by a falling dollar. International equities continued to climb in the third quarter despite a 0.93% rise in the dollar (Source: Bloomberg). The MSCI Emerging Markets and MSCI EAFE Index rose 4.23% and 10.08%, respectively, in the third quarter and are now up 25.16% and 22.34% through September (Source: Bloomberg).

Investment grade bonds continued to generate solid returns for investors. Treasury rates fell across the curve (Source: Bloomberg) while credit spreads remained tight. The Bloomberg U.S. Aggregate Index rose 2.03% in the quarter and is now up 6.13% for the year.

Gold’s rally accelerated with a 16.12% quarterly gain leaving the yellow metal up 45.43% year-to-date (Source: Bloomberg). Foreign central bank buying, declining interest rates, and economic turbulence are likely contributing to gold’s impressive performance. Whatever the reason or reasons, its price increased about twice as much as the red-hot S&P 500 Information Technology Sector in the first nine months of the year.

Equity Rally Broadens

One of the critiques of the rally in the S&P 500 was that it was a narrow rally led by a few mega-cap technology stocks. That was not true in the third quarter, even though several mega-caps continued to shine. The Russell 2000 Index, a commonly used small-cap benchmark, increased 9.25% in the quarter after underperforming in the first half of 2025. It is now up 12.02% year-to-date (Source: Bloomberg). Lower short-term rates may have contributed to the Russell 2000’s rally. Smaller companies tend to be more leveraged and borrow at floating rates as opposed to their larger blue-chip competitors that have access to bond markets and in some cases, net cash on their balance sheets. The bottom line is that lower rates tend to be good for leveraged small cap companies.

While small and mid-capitalization stocks outperformed in the third quarter, one quarter does not make a trend, and we still favor large capitalization stocks. Their strong balance sheets, defensible business models and earnings growth should allow them to prosper moving forward. Nevertheless, it is nice to see smaller stocks participate in the rally.

The Federal Reserve Cuts the Federal Funds Rate

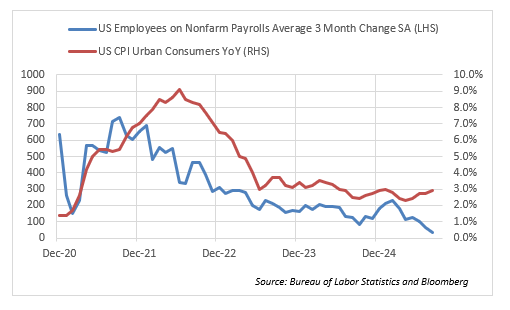

While strong earnings remain key, there are risks that can derail this rally. One of our concerns is the Federal Reserve’s dual mandate which requires it to worry about inflation and labor markets. For the last several decades, there have been few times when the Federal Reserve’s dual mandate resulted in trade-offs. Higher inflation coincided with strong labor markets, while weaker labor markets saw lower inflation. Now, the Federal Reserve is dealing with softer labor markets and inflation that remains persistently above two percent (see chart).

Despite the somewhat troubling inflation data, Treasury yields fell in the quarter, but more so on the short end of the curve. The yield on the one-year Treasury declined 0.35% while the yield on the two-year Treasury and ten-year Treasury fell 0.11% and 0.08%, respectively (Source: Bloomberg). Shorter rates fell in part due to the Federal Reserve’s rate cuts, and the expectation of more to come.

Fed Chair Powell indicated at Jackson Hole that the Federal Reserve would likely lower interest rates (Source: Cox, J. (2025.08.22), CNBC.com), and followed through with a twenty-five basis point cut on September 17th. Markets are currently predicting 1.75 additional twenty-five basis point rate cuts in 2025 (Source: Bloomberg). However, there is no guarantee that the Federal Reserve will continue to lower interest rates if inflation does not cooperate. Worse yet, there is a chance inflation accelerates while labor markets weaken. If that happens, Continuity thinks that the Federal Reserve lowers short-term rates, but long-term rates do not cooperate and move higher. The Ten-Year Treasury Rate ended the quarter yielding 4.15%. It closed at 4.03% on September 16th, the day before the Federal Reserve lowered rates (Source: Bloomberg).

Government Shutdown Looms

A government shutdown went into effect on October 1st. This is the first shutdown since the 2018-19 shutdown that lasted thirty-five days (Source: Wikipedia). Shutdowns are not productive, but neither are they something that should lead to major portfolio changes. The looming shutdown could lead to a market pullback. However, we do not think long-term investors should adjust their investment outlooks because of it. The market bottomed out in 2018 on December 26th, four days after the shutdown started (Source: Bloomberg). It proceeded to rally nearly forty-five percent until the pandemic occurred. However, the S&P 500 and equity markets did experience a correction before the shutdown occurred.

Strength Begets Strength, but Equities are due for a Pause

The rise in equity markets following the tariff-induced correction has been relentless. The S&P 500 is up 38.33% from the closing low reached on April 7th. Meanwhile international markets have outperformed the S&P 500 year-to-date. Continuity thinks equity markets are due for a pullback or pause, but frequently, strength begets strength. We would not be surprised if the market rally continues.

Continuity expects fixed income returns will remain solid. Another rate cut or two are likely in 2025 but are not a certainty. The Federal Reserve is data-dependent and should inflation become a bigger short-term risk than unemployment, the Fed will likely pause lowering rates.

Continuity does not think the government shutdown will lead to a deep correction. We are monitoring the possibility of a pullback due to the government shutdown and the corporate quiet period. If a bigger pullback occurs, we suspect it will be due to something most investors are not factoring into their market outlooks. Despite strong returns, we remain cautiously optimistic and will continue to adjust portfolios on the margin while focusing on the long-term.