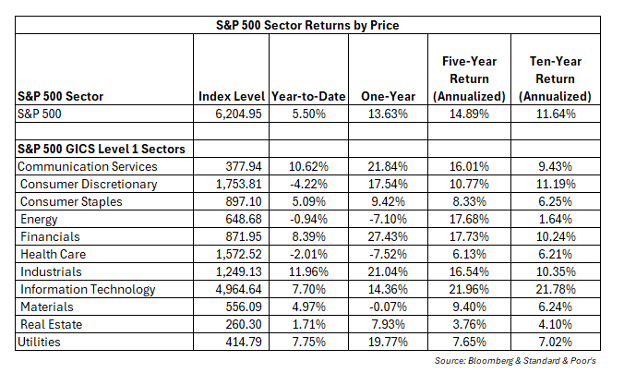

Tariff uncertainty led to a steep drop in equity prices during the first eight days of April. During that period, the S&P 500 fell 11.21% to close at 4,982.77, before rallying powerfully after President Trump announced a delay in tariff implementation to allow time for negotiations. The S&P 500 reflexively bounced as the worst-case scenario was avoided. The rally continued thanks in part to resilient corporate earnings which exceeded expectations (Source: Bloomberg). The S&P 500 went on to gain 10.57% for the quarter and 5.50% year-to-date, setting new all-time highs on June 27th and June 30th.

Tech stocks lagged in the first quarter, but that underperformance turned out to be a buying opportunity. There was little to no evidence of weakening demand for NVIDIA chips or AI models in the second quarter’s earnings reports. The information technology sector and the communications services sector both increased more than eighteen percent for the quarter and outperformed the S&P 500 through June 30th. Eight of the eleven sectors are now up for the year. The consumer discretionary sector was the worst performing sector year-to-date, although it rose 11.32% in the second quarter, outpacing the S&P 500. The year-to-date underperformance of the consumer discretionary sector is largely due to weakness in several retail stocks, homebuilder stocks, and Tesla (Source: Bloomberg).

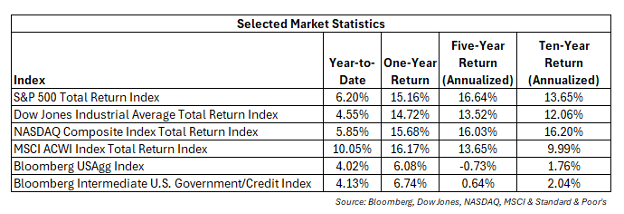

International stocks have still outperformed the S&P 500 Index year-to-date, even though U.S. stocks have slightly outperformed the MSCI ACWI Index since April 15th.

Bonds performed well during the second quarter, helping diversified portfolios maintain their value amidst the turbulence. The Bloomberg US Aggregate Bond Index and the Bloomberg Intermediate US Govt/Credit Index are up 3.65% and 3.91%, respectively, through June 30th. The indices almost matched the performance of the S&P 500 with lower volatility.

Gold prices rose by an impressive 25.24% in the first half of the year. Gold has been a good diversification tool absolutely and relatively for equity investors. However, it has moved sideways since April as tariff uncertainty moderated, and equities rebounded.

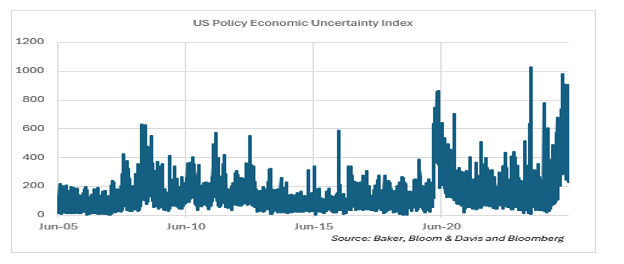

Economic and Geopolitical Uncertainty Continues

Policy and economic uncertainty rose in the first half of 2025 (see chart). Tariff policy led to or contributed to reduced corporate investment and increased market volatility. Internationally, the Ukraine-Russia war continues, while the Israel-Iran conflict escalated before a ceasefire was announced. Investors seem unphased about the Israel-Iran conflict. Oil prices are down 8.91% quarter-to-date and 9.22% year-to-date, according to Bloomberg.

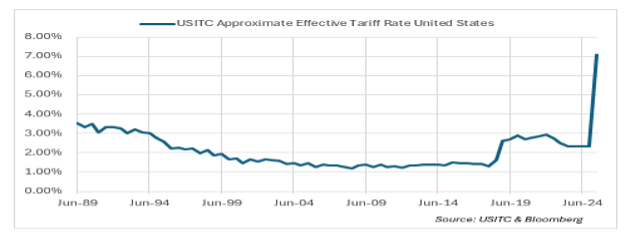

Arguably, the greatest source of uncertainty was due to tariff and trade policy. Tariffs were increased but then largely deferred pending negotiations. Nevertheless, new tariffs remain in place that were not in force before the election. The final effective rate is not known, but it looks like it will be significantly higher than any time in the recent past.

US relations with its friends and rivals have been challenged since Trump was inaugurated for his second term. Neither corporations, consumers, nor investors have clarity on tariffs or economic policy moving forward, but the worst-case scenario seems to have been avoided.

Domestic Equities Rebound

After a tough first quarter, the S&P 500 increased 10.57% in the second quarter to more than offset the 4.59% first quarter drop. An end to the worst-case scenario on tariffs led to a market bottom and a quick stock market recovery. The recovery continued, partially due to strong corporate earnings. With investors no longer focused on the macro, they were able to concentrate on corporate fundamentals. Second quarter earnings and outlooks were solid, and helped push stocks to new all-time highs.

Tariffs and geopolitics received attention in the first half of the year, contributing to the correction. Our hope is that strong corporate earnings and a solid economy will lead to decent returns in the second half of the year. We cannot know to what extent sales were pushed forward by companies trying to get ahead of tariffs. There could be a payback in the form of lower sales in the quarters ahead. Additionally, it remains to be seen by how much or if tariffs will diminish profitability.

On the plus side for earnings, the dollar has weakened since reaching a 2025 high of 110.18 on January 13, (source: Bloomberg). The dollar closed the quarter at 96.88, which represents a drop of 12.07% from its 2025 high. Multinational companies must translate profits earned overseas into dollars. A weaker dollar raises the value of those earnings. Accordingly, companies with a greater percentage of their profits generated overseas stand to benefit from the weakened dollar.

Bonds Shine in the First Half of 2025

After stabilizing portfolios in the first quarter when American equities fell, fixed income investors were rewarded in the second quarter as well. The Bloomberg US Aggregate Bond Index increased 1.21% for the quarter and was up 4.02% in the first half of 2025. Strong performance was not concentrated in the investment-grade debt space. High-yield debt also generated strong returns for investors. The Bloomberg US Corporate High Yield Total Return Index increased 3.53% and 4.57%, respectively, for the three months and six months ended June 30, 2025.

Fixed income returns should be influenced by payroll and inflation reports in the second half of 2025. The Federal Reserve often says it is data dependent, and so is the bond market. Regarding inflation, it is important that tariffs do not reverse the progress in bringing inflation down. Meanwhile, some Bureau of Labor Statistics reports have pointed to a softening job market. The Federal Reserve’s dual mandate of low inflation and strong labor markets could bump up against each other.

According to Bloomberg, the futures market implies one rate cut in the third quarter at the September meeting, and we agree with the market’s assessment. The market is forecasting two to three rate cuts by the end of 2025. People like to think that rate cuts are good for equity markets, but the reason is important. More than three rate cuts will almost certainly indicate a quickly weakening economy. This should be good for Treasuries, but equities would probably fall in this scenario. Two or three rate cuts would likely be supportive of bonds and stocks, assuming they are accompanied by growing employment and stable inflation.

Looking Ahead to the Third Quarter

The first half of the year generated strong equity returns despite the volatility. Earnings growth has been good, but valuations are full. We think equities are due for a pause. Longer-term, we still like technology stocks. International stocks can provide diversification, especially if the dollar continues to decline.

We like fixed income here. Continuity thinks the economy will continue to expand and inflation will remain contained longer-term despite tariffs. Under this scenario, most fixed income categories should do well. However, there are many unknowns that make the range of outcomes wider than normal. In our mind, weak labor markets are a bigger risk than inflation at present.

The world remains riddled with uncertainty. Continuity thinks investors should remain diversified. We think fixed-income investors will do well in the back half of 2025. Equity investors should expect volatility, but any pullback is likely to be another buying opportunity.